A credit score is a number from 300 to 850 that is calculated based on the contents of a person’s credit report and reflects how responsibly the individual has managed loans, lines of credit, and other financial obligations over the years. Credit scores are extremely important because they affect each person’s ability to borrow money as well as the cost of doing so. They also play a role in the car insurance premiums we pay. Plus, bad credit can even make it difficult to find a job or a place to live.

Check Your Latest Credit Score – 100% Free

“Credit score” is a pretty general term, though. We each have hundreds of different credit scores. And the ones lenders use to evaluate applications aren’t always available to us. But two types of credit scores in particular are popular among lenders and consumers alike: FICO Scores and VantageScores.

You can check your latest VantageScore credit score for free on WalletHub. And you can learn more about the most popular types of credit scores below. In particular, we’ll break down each of the ingredients in your credit score and explain how to improve it.

Credit Scores In Depth

Credit scores are based on the information in our major credit reports. Understanding that connection is the first step in understanding your credit score.

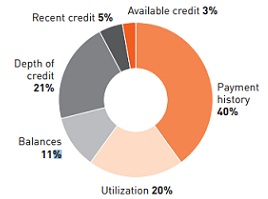

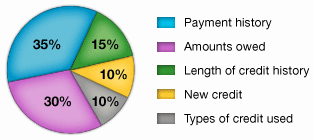

The next step is to get a feel for the recipes used to turn credit-report info into credit scores. Below, you can see how the two most popular types of scores weigh the various ingredients. Other types of credit scores may be calculated a bit differently, but they will likely produce very similar results.

VantageScore FICO Score

If you have good marks in each of these categories, your credit should be good no matter what score is used. Continue reading to learn more about what each category includes. You can also check your own grades with WalletHub’s free credit analysis.

Payment History

Payment history is the most important part of any credit score, accounting for up to 40% of your overall rating. Here’s what goes into it:

- The number of loan and credit accounts that you have always paid on time.

- The number of accounts for which you are currently at least 30 days behind on payment.

- Whether or not you have gone bankrupt, had past due accounts sent to collections, or fallen at least 30 days behind on a loan or line of credit. The recency of these items will also factor in.

- How many days past due you are on delinquent accounts.

- The dollar amount past due you are on delinquent accounts and/or accounts sent to collections.

Given that a credit score is a reflection of your financial responsibility, it makes sense that you will be dinged for failing to make payments as agreed on certain types of accounts.

Amounts Owed

The money you owe lenders accounts for at least 30% of your score. It’s an indicator of whether your spending habits are sustainable and if you’re likely to face serious financial problems in the future.

This part of your credit score is based on the following factors:

- The number of accounts you carry a balance on;

- Your credit utilization ratio; and

- How much you currently owe on credit cards and installment loans.

Lower is better with each of these data points, which may be grouped together or separated into individual scoring categories. It depends on the type of credit score. VantageScore, for example, has separate categories for balances, available credit, and utilization.

Length/Depth of Credit History

How long you’ve been using loans and lines of credit is important to the predictiveness of a credit score. For example, a good credit score based on years of information has a better chance of accurately forecasting a borrower’s risk than a good score based on a month or two of information. Years of positive information also make the occasional mistake less damaging.

Bear in mind, however, that it’s not when you first used credit that really matters. Rather, credit scores generally use the age of the oldest open account on your credit report or the average age of your open accounts.

This, along with the types of credit you use, makes up the Depth of Credit portion of a VantageScore.

Types of Credit Used

This category measures how many different types of credit accounts you’ve used and how recently you’ve used them. For example, some common types of accounts include credit cards, personal loans, retail lines of credit, auto loans, and mortgages. In general, the types of credit you’ve used show how well-rounded of a borrower you are.

New/Recent Credit

Credit-scoring companies use this “what have you done for me lately” category to emphasize recent financial performance. After all, that’s one of the best predictors of future performance.

This section includes:

- How many loans and lines of credit you’ve opened in recent months as well as how that number compares to the total number of accounts in your credit history.

- How long it’s been since you opened your newest accounts.

- The number of hard inquiries (i.e. how many times you’ve applied for credit) made into your credit history in the last 12 months.

- How long it’s been since your last credit inquiry.

In short, creditors want to know whether you’re desperate for additional credit. That’s a red flag for a high-risk borrower.

How to Check & Improve Your Credit Score

Credit scores are pretty fluid and capable of changing whenever new information gets added to our major credit reports. So it’s worth checking them on a regular basis. If you want to see what your credit’s been up to, you can check your latest credit score for free on WalletHub. WalletHub that offers free daily credit score updates, so there’s no better place to monitor your score’s progress.

Your free WalletHub account also comes with customized credit analysis. Basically, we’ll review each component of your score and tell you how to improve. You can also test credit moves before you make them using our credit score simulator.

Ask the Experts: Credit Score 101

People often overcomplicate things when thinking about credit scores. So to help simplify things in your mind, we posed the following questions to a panel of personal finance experts. You can see who they are and what they said below.

- What do you think is the biggest misconception that people have about credit scores?

- The Consumer Financial Protection Bureau found a 90% correlation among the results produced by a collection of the most popular credit scores - what is the biggest takeaway for consumers?

- Do you think most people understand there is not a single “real” credit score?

- Do you think the average person checks his or her credit score often enough?

Ask the Experts

Associate Dean and Professor of Finance in the Fowler College of Business Administration at San Diego State University

Read More

Assistant Professor of Accounting at Gwynedd Mercy University

Read More

Dean for the Davis College of Business at Jacksonville University

Read More

Associate Professor of Accounting at Stetson University

Read More

Instructor in the Division of Business and Information Technology at Atlanta Metropolitan State College

Read More

Assistant Professor and Coordinator of Business Programs in the Department of Business & Technology at Kankakee Community College

Read More

WalletHub experts are widely quoted. Contact our media team to schedule an interview.