6 Types of Credit Cards

- Standard unsecured credit cards

- Secured credit cards

- Credit cards for students

- Small business credit cards

- Store credit cards

- Charge cards

These six types of credit cards differ based on the type of user they’re intended for, where they can be used, and what’s required of applicants.

That being said, how many different types of credit cards there are depends on how you look at it. There are far more credit card categories if you break things down by feature, for example. The best 0% credit cards are different from the best cash back credit cards, which are different from the best travel credit cards, and so on.

There are more than 1,500 credit cards available overall. And having so many options can make finding the right one rather difficult. But WalletHub has your back. Below, we’ll highlight all the different types of credit cards you’ll come across as well as some of the best examples of each. We’ll also give you some tips for choosing the right card for you.

Opinions and ratings are our own. This content is not provided, commissioned or endorsed by any issuer. WalletHub independently collected information for some of the cards on this page.

Types of Credit Cards by Feature

Continue reading to learn more about what separates the various types of credit cards available to you right now. You can also try WalletHub's free CardAdvisor tool to get personalized recommendations.

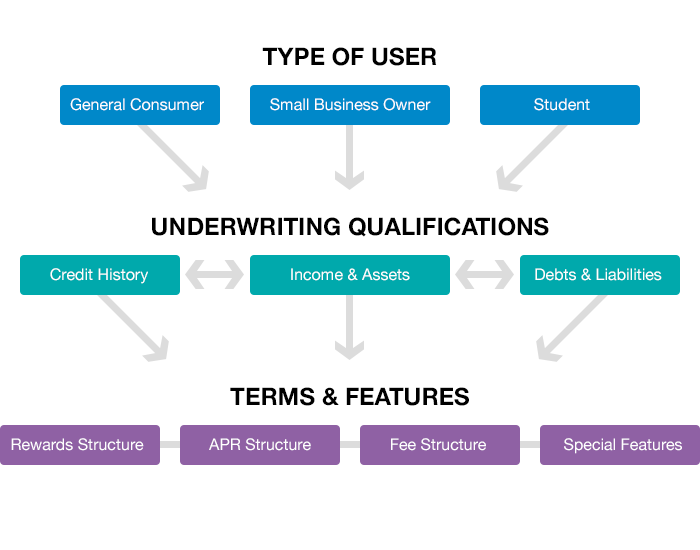

Credit Card Types Hierarchy

Credit card offers are designed for specific types of users. And there’s a very good reason for that. By creating cards that appeal to a particular group’s interests and financial needs, credit card companies can strike a profitable balance between popularity and risk management.

It all starts with figuring out whether the card is for a student, small business owner or ordinary consumer. Student and business cards play by somewhat different rules, due to differing consumer protections and their users’ unique financial needs. Next comes the intended user’s financial profile, including credit history, income and debt. And, finally, the rates, fees, rewards and other features fall into place.

Given how many variables go into creating a credit card offer, it’s easy to see why there are so many different types.

Types of Credit Cards by User Category

In the most general sense, there are three main types of credit cards: those intended for use by students, small business owners, and the broader consumer population. These card types are the same as far as overall appearance and functionality are concerned, yet have a few key differences when it comes to product terms, approval criteria, and even consumer protections. As a result, they’re uniquely positioned to meet the needs of their respective target audiences.

General Consumer Credit Cards

What most people consider “normal credit cards,” general-consumer cards comprise the largest segment of the market. Their overall value varies widely, based on issuer, card network, credit standing requirements, and a number of other factors. The CARD Act applies to general-consumer credit cards, which means users are eligible for all available rights and consumer protections.

Compare General-Consumer Credit Cards

Student Credit Cards

Credit card companies consider students to be a unique group because their income is limited in the short term, yet their advanced level of education gives them above-average earning potential, and their youth means years and years of future financial needs (i.e. a lot of revenue for financial institutions). As a result, students are usually able to get more attractive credit card offers than their experience and financial circumstances would ordinarily merit. Student credit card users are eligible for all consumer protections.

Business Credit Cards

The small business community has unique financial needs, which merit a unique type of credit card. Business credit cards tend to offer higher credit lines than their general-consumer and student counterparts. They also give you special expense tracking features, the ability to customize spending limits for employee authorized users, and rewards targeted to common company expenses such as office supplies and telecommunications services.

To get a business credit card, you must be the owner or principal of the business AND be able to provide a Tax ID Number (TIN) or Employer ID Number (EIN), along with your personal Social Security number (SSN). The need to provide your personal SSN is evidence of the fact that you will be held personally liable for business credit card debt.

Small business credit cards are not covered by the CARD Act, which means users are not eligible for a number of important consumer protections. This includes the rule against arbitrary interest rate increases. However, certain issuers have voluntarily extended key parts of the CARD Act to their small business customers. You can find a breakdown of their policies in WalletHub’s latest Small Business Credit Card Study.

Types of Credit Cards by Underwriting Qualifications

The credit card business is all about evaluating and minimizing risks in order to ultimately maximize profits. And determining whom to approve for which cards is a huge part of that. Here are some of the most important factors credit card companies consider when making those decisions:

Credit History

There’s a reason credit card companies “pull” your credit reports after you submit a credit card application: They want to see how you’ve used credit in the past, as that’s the best indicator of future performance. Credit scores, as you may already know, are based on the information contained in these reports. And we’re all labeled as having excellent, good, fair, limited or bad credit, depending on the nature of that data. Likewise, there are credit cards for people with excellent, good, fair, limited and bad credit. People with excellent credit naturally get the best deals.

Income & Assets

Credit card companies are required by law to determine whether an applicant will be able to make at least the minimum monthly payments required to stay current on a new line of credit. Evaluating each applicant’s income and assets is part of that.

Debts & Liabilities

Only considering an applicant’s income and assets would paint a deceiving picture of his or her ability to pay. So issuers must also take debts into account to get a true sense of an applicant’s disposable income. How much money you have available for a new line of credit has a direct impact on your ability to get approved for a good account.

Altogether, these three factors comprise your overall “creditworthiness” and dictate which types of cards you can get approved for.

Types of Credit Cards by Product Terms

A credit card’s specific terms and features are what gives it character and sets it apart from other products vying for the business of a particular demographic.

Rewards Structure: Credit cards offer spending-based rewards in terms of cash back, points, and miles. Some cards offer the same per-dollar “earning rate” across all purchase types, while others provide extra rewards in certain specific categories, such as gas, groceries, or travel. In addition, it’s common for cards to offer initial rewards “bonuses,” whereby the user is awarded a lump-sum allotment of rewards after their first purchase or as a result of meeting an initial spending requirement.

Recommendation: Gravitate toward cash back rewards with lucrative earning rates in your biggest everyday expense categories, while periodically supplementing your earning power with an attractive initial bonus deal.

APR Structure: All credit cards charge interest. And if you don’t pay off your full balance at the end of each billing period or you make the unwise decision to do a cash advance, you’re going to get hit. More specifically, credit cards generally have three different types of interest rates that are relevant when shopping for a credit card offer: an introductory rate for balance transfers, an intro rate for new purchases, and a regular APR. Sometimes they’re the same. Sometimes they’re not.

Recommendation: You only need to concern yourself with a credit card’s APR(s) if you wish to reduce the cost of existing debt via balance transfer, you don’t pay in full at least two months out of the year, or you are planning a big-ticket purchase that will take a few months to pay off. In any case, use of a credit card calculator is wise, as it will help you not only find the card that saves you the most, but also develop a strategic payoff plan. We strongly advise against using a credit card like a debit card (i.e. doing a cash advance) due to the prodigious cost.

Fee Structure: Like most financial products, credit cards are known to charge a number of different fees, ranging from annual membership fees and balance transfer fees to foreign transaction fees and cash advance fees.

Recommendation: In most cases, a credit card’s membership fee is the only fee you’ll need to concern yourself with. And in most cases, your objective should be to minimize what you pay. The exception would be if you were able to get a rate or rewards deal lucrative enough to exceed the competition’s value, even with an annual fee considered. Only consider peripheral fees if you plan on making the type of transaction with which they’re associated (e.g. balance transfer fees and balance transfers).

Types of Credit Cards by Special Characteristic

Credit cards are further specialized based on certain unique characteristics designed to meet consumer needs, encourage spending, limit issuer risk, and solidify corporate relationships.

Secured Cards

Secured cards often represent the best credit card option for people with bad, limited, or no credit history. They are practically identical to general-purpose credit cards, with the sole exception being that a security deposit is required to open a secured credit card. This deposit is fully refundable and will be returned to you upon closing your account with no outstanding balance.

You can fund this deposit in multiple ways, including via checking account, money order or cash (in the event that the bank offering the secured card has a branch in your area). Given that the security deposit typically serves as a secured card’s credit line, most issuers offer nearly guaranteed approval, as there is no threat of a consumer not paying back what he owes.

Organizational Affiliation

Co-branded and affinity credit cards are linked to particular companies, organizations, and groups – ranging from professional sports franchises and travel providers to universities and professional organizations. Such relationships are designed to pique the interest of related consumer segments as well as reward users for their organizational loyalty.

Merchant Affiliation

Store credit cards are directly linked to particular retail chains and can only be used at their stores. For example, the Target REDcard will only work at Target locations. Store cards tend to offer unique rewards at the retailers with which they’re affiliated as well as more lenient underwriting requirements than the general card population since they are designed to encourage added store spending among as many customers as possible.

No Pre-Set Spending Limit

Most types of credit cards have fairly stable spending limits / credit lines that only change based on unique economic circumstances and changes in user performance. Most cards also clearly convey how much you are able to spend. With No Pre-Set Spending Limit (NPSL) credit cards, however, your spending limit will likely be a mystery and may change on a monthly basis. American Express charge/hybrid cards, World MasterCard credit cards, and Visa Signature credit cards commonly have this feature.

Charge Cards

Charge cards are identical to general credit cards, except that you must pay your total balance in full every month

Types of Credit Cards by Network

| Card Type |

Visa | Mastercard | American Express | Discover |

|---|---|---|---|---|

| Unsecured | Yes | Yes | Yes | Yes |

| Secured | Yes | Yes | No | Yes |

| Charge Card | No | Yes | Yes | No |

| Cash Back | Yes | Yes | Yes | Yes |

| Travel | Yes | Yes | Yes | Yes |

| Business | Yes | Yes | Yes | Yes |

| Student | Yes | Yes | Yes | Yes |

| 0% APR | Yes | Yes | Yes | Yes |

| $0 Annual Fee | Yes | Yes | Yes | Yes |

Some people consider cards from the four major networks – Visa, Mastercard, American Express and Discover – to be different types of credit cards. That’s not quite accurate, though, as a credit card’s network mainly dictates where the card can be used. A Visa credit card is not fundamentally different than a Mastercard credit card, for example.

One type of credit card you won’t find on any network is a store credit card. That’s because store cards can only be used at the merchants they’re partnered with, while credit cards that are on a network can be used anywhere.

Bottom Line

There are lots of different types of credit cards and more than 1,000 individual offers. But all that matters is finding the right one for your needs. And there are a few ways to do that, some of which are easier than others.

For starters, you can sign up for a free WalletHub account to get personalized credit card recommendations with high approval odds and terms that will save you money, based on your credit history and financial goals. You can also try our free, anonymous CardAdvisor tool, which suggests cards based on your answers to a few simple questions. Alternatively, you can check your latest credit score to see what kind of card you're likely to qualify for, determine what features you want most, and compare credit card offers until you find the best deal.

However you decide to hunt for the right credit card, it's important to remember that you don't need to find one card for everything. Perfect credit cards don't exist, so the best way to get the best terms is to build a collection of cards that excel in specific areas. For example, you might have a cash back credit card for everyday purchases and get a 0% credit card before a big-ticket buy. Don't apply for multiple cards at once, though, as that can hurt your credit score.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.